Section 8.1

V3 ERP Implementation case study -- headlines

The headlines of the V3 ERP Implementation case study are as follows:

1. ERP that James Robertson was involved in architecting and designing

2. Cubic business model based on Chart of Accounts resulting from 1,000 hour investment

3. "More management information than we know what to do with" – very happy client

4. One less bookkeeper

5. Audit complete in six weeks, previously six months

6. Balance sheet unqualified for the first time in fifteen years

7. Presentation with client – greatest recommendation

The Benefits of Management Information Systems to the Professional Practice

SAICE 15th Annual Conference on Computers in Civil Engineering

By

Dr James A Robertson PrEng & Reg M Barry, Financial Director, V3 Consulting Engineers

SYNOPSIS

The advent of commercially available practice management software for the South African Consulting Engineering Industry some years ago, introduced the possibility of introducing far reaching, tailored, management information systems into the professional practice. This paper sets out to highlight some of the experiences and particularly the benefits derived from one such installation two years after implementation. The system comprises an integrated job costing, billing, debtors and creditors system linked to a comprehensive financial management system and an executive information system offering a wide range of management reports and graphical analysis.

Benefits experienced include the reliability and timeousness of the information, financial results are typically available within ten days of month end and year end financials within the same time frame at reduced audit cost and greater precision. A wide variety of reports are available and the organization can be viewed as a "Rubics Cube" of information in which the information can be grouped and examined in a wide variety of ways allowing project, client, profit center and other views of performance according to management's needs. Full activity based financial analysis and overhead distribution is supported eliminating the approximations typically made in assessing profit distribution and recognizing marketing and management contributions.

Senior management have had their workloads on mundane analysis greatly reduced while obtaining more accurate information faster. Information is also available at different levels of the organization at different levels of detail. Enquiries from a very summarized executive view to a very detailed transaction level analysis allow effective management by exception with drill down to specific problems. The variety of analyses possible offers great scope for effective management and directed marketing in a manner which should allow the company to create and sustain competitive advantage.

INTRODUCTION

The evolution of computer technology in the late eighties gave rise to a situation at V3 Consulting Engineers in 1989 where the existing projects system was becoming obsolete and no longer able to cope with the demands of the firm. Over the period 1989/90, the management of the firm undertook a number of preliminary reviews of commercially available software and subsequently commissioned a detailed study of the firm's requirements in which the relative strengths and weaknesses of the commercially available software packages was evaluated (Robertson 1990).

It was established that neither of the major packages available were ideally suited to the needs of the firm and further analysis was undertaken to establish in greater detail the scope of modifications required. Following negotiations with the vendors, a scope and budget for the required changes was agreed and a final decision taken as to which system to purchase. The selected system was a South African developed package already in use at a number of consulting engineering firms.

A period of software enhancement by the developers was followed by testing and pilot operation, the system was commissioned and ran live in the Cape Region of V3 in October 1991. Thereafter the system was installed in the Free State and Transvaal regions, running live from March 1992.

This paper outlines some of the experiences with the implementation with particular emphasis on the benefits derived from the use of the system.

SYSTEM OVERVIEW

The system selected comprised a number of major components:

Projects System

The projects system comprises a suite of programs including projects and personnel databases, salary and rates information. A company parameters module allows configuration of the system to model the organizational structure of the practice to take account of offices, departments and associated companies as well as to define the nature of the general ledger interface. A variety of set-up options allow further customization of the operation of the software.

The projects system provides full features for the entry and processing of time and expense information with comprehensive analysis of Work in Progress (WIP). WIP is maintained on an open item basis such that once captured, all items remain in the system until they are either recovered through billing to the client or written off. Full audit trails and analysis reports are available on the WIP. The project system includes a largely automated billing system.

The projects system also provides a wide range of facilities for structuring up to 5 levels of project detail and associated analysis together with activity codes and a variety of project budgeting and reporting options.

The projects system is integrated with debtors and creditors modules to allow full management of these accounting functions with project related reporting in debtors and both project and non-project expenses posted in the creditors program.

All financial components of the projects system are integrated on a batch basis with a commercial general ledger package.

Financial System

The financial system comprises a commercial general ledger package together with integrated cash book software. This is linked on a batch basis to a commercial salary package. The financial system has recently been extended by the acquisition of an integrated assets register package and barcode reader. The financial system replaced 24 column manual cash books.

The general ledger chart of accounts accommodates a comprehensive, fundamental analysis of all income statement and balance sheet items in a manner that is linked to the business model of the organization in terms of cost and profit centres including physical branch offices and administrative, technical and support departments. A hierarchical, structured coding scheme is employed in order to facilitate allocation of expenses on an activity basis, and to allow progressively more detail in enquiries. Associated with the chart of accounts, a variety of financial reports allow summary or detail reporting for the region, office or department as required, including summary and detail income statements, balance sheet, cash flow projections and ratio analysis.

The financial system is linked directly to the projects system in a manner that is designed to support activity based costing and allocation of income and expenses in a manner that permits clear definition of ownership of information with a view to achieving a high level of internal auditing and a resultant improvement in accuracy and reduction in audit delays.

National Consolidation

In the past year, procedures have been implemented to permit all financial results to be consolidated nationally at the detail level, thus permitting the extraction of a wide variety of detailed and summary analyses. Various controls on inter-region charges have also been implemented together with procedures for accumulation and distribution of corporate overheads.

Executive Information System

Recently a graphical Executive Information System (EIS) has been developed to operate on the underlying operational projects and financial systems. This EIS has been developed using a commercial, windows based tool and provides a high level of graphical summarization of certain key values in the projects and financial systems. Development is continuing.

The EIS system has been developed with the objective of enabling senior management to see key values summarized graphically in a meaningful way that allows them to rapidly identify potential problems and drill down to the detail in any way that they may consider necessary. Particular emphasis was placed on achieving a user interface that was intuitive for senior management and did not restrict enquiries on the basis of simplifying assumptions made during construction. The EIS also provides an interactive mechanism for overhead distribution on an activity basis, whereby all income and expenditure relating to non-production business units is distributed over the production units on an agreed basis. The model has been designed with a view to providing management with the means to examine the effect of alternative allocation formulae on the profitability of individual business units without altering the underlying data which has been allocated on a fundamental basis.

The ultimate objective set for the EIS is to support a "paperless board meeting" in which all relevant information is projected onto a screen in the board room so that managers can analyze and query information interactively and pro-actively thus facilitating management by exception rather than tabling large volumes of information.

OBJECTIVES FOR THE SYSTEM

A number of short term and long term strategic objectives were set for the system at the time that the initial investigation (Robertson 1990) was undertaken. Particular emphasis was placed on specifying the objectives and requirements for the system with the objective of meeting the long term strategic requirements of the firm with a view to avoiding the need to replace the system after a few years. Objectives set included:

- Provide tools to monitor and improve productivity and profitability.

- Enable profitability to be measured on a project, department and office basis using the cubic model proposed by Robertson.

- Assist the firm to offer the highest possible levels of service to it's clients.

- Ensure that charges for work were realistic and that work was performed effectively for the client.

- Provide comprehensive budgeting facilities for projects and financials.

- Assist in the evaluation of current and future directors with respect to appointment and promotion.

- Provide concise management summaries.

- Permit a global view of the practice.

- Permit detailed enquiry on all aspects of operations and job costing.

- Require minimum management time and manpower to operate system.

- System must be affordable.

All of these objectives have been met at the current time although costs have been greater than expected and would be handled differently if the project was undertaken today. Certain specific benefits are discussed in more detail in subsequent sections.

IMPLEMENTATION EXPERIENCE

The implementation was undertaken in a phased manner, as outlined previously. Problems were experienced in terms of availability of senior personnel in-house at certain times and in terms of commissioning the system in other regions using in-house personnel. This was undertaken with a view to cost containment but ultimately gave rise to increased costs associated with correction of problems experienced.

With hindsight, more use should have made of outside assistance in the implementation in the second and third regions. In-house staff were not experienced enough and the time they spent in other regions placed pressure on their own region's operation.

Time taken to achieve understanding and commitment to the new system by managers and staff at all levels proved to be greater than anticipated and required focused and firm action by top executives before all required information was provided by project leaders and other staff and proper use was made of management reports. Experience tends to support the widely reported view that a paradigm change of this magnitude requires between three and five years to become permanent in an organization.

BENEFITS OF THE SYSTEM

The projects system has now been in operation in the Cape Region of V3 for close to two years and in the rest of the country for eighteen months while the financial system has been in use country wide for eighteen months. As stated above, the objectives set three years ago have all been met. Specific benefits are discussed in the sections that follow:

Reliability and Timeousness of Information

Information is readily available, in many cases almost instantly. For example, analysis of time sheet data and other data captured to projects is available within two working days of the end of the month.

Full analysis of project performance for the month is available immediately data capture is completed including a wide variety of budget, costing and profitability reports. Up to date sales journals are available at any stage as are debtors and creditors age analyses. The EIS projects analysis can be made available within twenty four hours of month end or updated more frequently as appropriate.

Full financial statements including summary and detailed income statements, balance sheets and cash flow projections are generally available ten days after month end and include all closing and balancing adjustments for the period in question so that there is considerable confidence in the reliability of the information. The EIS financial analysis can be made available at the same time.

Because of the wide variety of combinations and groupings in which the information can be presented and the wide variety of controls built into the system, it is possible for all information to be reported in a manner which allows recipients to accept full ownership of specific sets of data. This facilitates verification and control and allows senior management to operate on the basis that, "if all subordinate managers have accepted the accuracy of their figures, the consolidated figures must be correct". This ensures a high degree of reliability and confidence in the information.

As a result of the detailed analysis contained in the general ledger, it is possible to operate the financial system in such a way that very little additional processing is required at year end over that required at month end. While some difficulties were encountered at the end of the first year of operations since not all procedures were fully in place, it was still possible to table the year end figures 17 days after the end of the year and they were signed off without qualifications by the auditors approximately five weeks later.

The Cubic Business Model

The business model referred to earlier allows the databases to be viewed as a multi-dimensional "Rubic's" cube which can be rotated and viewed in a wide variety of different ways. This permits the financial and production information to be grouped and summarized by office, department and region. Production (project) information can also be viewed by project leader, technical director, marketing director, client market segment, project discipline and client thus providing a fully market focused information capability. This information can then be used to focus marketing efforts and identify different marketing and management styles required for different market sectors as well as enabling management to evaluate the performance of individuals in terms of marketing and management contribution as well as production contribution.

In conjunction with these facilities, the activity based allocation of administrative overhead contribution by technical staff permits an accurate measurement of true profitability of individual business units or sub-units at a level which permits "level playing field" comparisons of business units. This eliminates the traditional problem of professional service organizations where the business units of those involved in management and marketing are penalized since only the production contribution is measured. Through this approach, inappropriate management decisions resulting from incorrect cost allocation can be avoided.

The system also supports attribution (allocation) of income from professional fees to the business unit employing the person doing the work. This permits the profitability of business units to be measured in terms of true, salary linked, revenue contribution as well as by the traditional method of project profitability and reduces the dependence on relatively arbitrary, rates based, costing approaches.

Senior Management Work Load and Effectiveness

Senior management have had their work load on mundane analysis greatly reduced as many of the analyses previously performed using spreadsheets have been incorporated into the system and are therefore available automatically with greatly reduced effort. Time spent resolving problems of mis-allocation and addressing queries with regard to year end has also been considerably reduced.

The multiple levels of summarization in conjunction with the high level of detail of the underlying data enable management to receive very summarized reports for routine management while affording them the capability to rapidly "drill down" to progressively more detail in order to answer queries.

Strategic Advantage

The wide variety of analyses available and the ready availability of information have freed management to be more effective while devoting less time to management and administration. At the same time, management have greatly improved scope to identify opportunities to improve operational effectiveness, increase delegation and improve profitability. They are also able to identify market related factors that can have a bearing on marketing strategy, product mix and other matters. These factors all enable the firm to offer innovative and competitive services in a competitive market. This is expected to assist the firm in creating and sustaining competitive advantage over the medium- to long- term as part of it's commitment to providing relevant, appropriate and cost effective services.

CONCLUSION

The components of a management information system (MIS) and associated financial and executive information systems have been summarized based on the experience of V3 Consulting Engineers. Certain experiences during implementation have been summarized and the objectives set for the system at the outset are reviewed. It is noted that these objectives have been met.

The benefits experienced by the firm are discussed with particular reference to issues such as timeousness and reliability of information, flexibility of analysis and control. It is noted that the work loads of senior management have been reduced while more accurate and detailed information is made available more rapidly. The ability to summarize the information in a great variety of ways while providing the ability to undertake enquiries at a very high level of detail when required, is noted as a further benefit.

It is concluded that the system has met most of the objectives set for it at the outset and that it is assisting the firm in it's objective of creating and maintaining competitive advantage through the provision of focused, appropriate and cost effective consulting engineering services.

REFERENCES

Robertson J A (1990) Report on Investigation Into Professional Practice Management Information Systems for Vorster, van der Westhuizen and Partners Unpublished report, October 1990.

September 1994

Download the V3 Consulting Engineers: The Benefits of Management Information Systems to the Professional Practice -- Article in Adobe pdf format

011 The Benefits of Management Information Systems to the Professional Practice -- by Dr James A Robertson PrEng from James Robertson

Download The Benefits of Management Information Systems to the Professional Practice v 003 -- Slides in Adobe pdf format

Download The Benefits of Management Information Systems to the Professional Practice v 003 -- Original Paper in Adobe pdf format

Section 8.2

CRM Risk Control case study -- headlines

The headlines of the CRM Risk Control case study are as follows:

1. A simple software application

2. Specified in two (2) days

3. Built in ten (10) days

4. Data engineering with full time executive input and facilitation ten (10) days

5. Extremely diverse range of management information

6. Four (4) operators captured about eight (8) times more information than twelve (12) operators would have captured previously

7. Primarily a Strategic Engineered Precision Taxonomy (SEPT) and Precision Configuration benefit

8. Presentation with client – greatest recommendation

Designing and Implementing an Integrated Risk Management System that Effectively Minimizes Your Exposure

Integrated Risk Management Conference

By Dr James A Robertson PrEng and George J Paton, Director, CRM Risk Control Consultants

SYNOPSIS

The management of risk in organizations today is becoming of increasing importance as insurance premiums and liability risks increase and as the hidden costs of risk in areas such as down-time, customer dissatisfaction and other factors increase.

Effective management of risk is therefore becoming a strategic necessity. Risk management in the area of physical risk is an aspect of business that is frequently overlooked or is approached on an ad-hoc basis. This paper sets out some of the factors that should be taken into account in implementing risk management solutions and identifies the need for such solutions to be holistic in nature. In particular, it is noted that the physical and financial components of risk management should be tightly integrated and that the management of maintenance on a risk containment basis is highly desirable.

It is concluded that the effective application of information technology in the form of an integrated loss acquisition database and management information system is vital to achieving the full potential of risk management in any organization. Some of the benefits of this approach are discussed together with a case history of a successful implementation.

It is concluded that the application of these techniques can give rise to a considerable improvement in profitability and should be a vital component of most organizations business strategy. Effective risk management supported by effective information systems can play a significant role in creating and sustaining competitive advantage.

1. INTRODUCTION

The management of risk in business today is a many faceted and complex task. Traditional approaches to risk management have focused on funding and financial issues rather than managing risk at source. As with maintenance, risk management has tended to concentrate on treating the symptoms rather than the cause. Events giving rise to large losses tend to originate from apparently insignificant occurrences with regard to wear and tear, maintenance and personnel which, with time, escalate to a point of giving rise to a major incident. The use of appropriate techniques to track small losses in a manner that enables management to analyze trends in such a way that proactive action can be taken to anticipate and prevent major losses and to identify the true cause of recurrent losses is vital to effective risk management that offers bottom line benefits.

In developing and implementing a risk management solution, it is important to recognize that a prime objective of the risk management function is to create a risk awareness culture in the organization in which there is an understanding of the adverse effects that risk exposure will have on the organization. As a consequence of this awareness and understanding, deliberate measures to minimize the potential impact on the organization should be implemented. A fundamental principle of risk management is a change in emphasis from an approach of contingency planning in the event of occurrence to proactive management directed at preventing risks from materializing. Risk management is therefore primarily a management function aimed at dealing mainly with uncertainties whilst taking cognizance of the consequences of pure risk and it's impact on business activities.

In designing a risk management solution, a number of tasks must be performed:

a. The potential impact of hazards on the effective operation of the business must be considered.

b. Steps necessary to achieve predefined objectives must be defined.

c. Risk improvement programs to reduce the probability of occurrence of risks must be developed.

d. Alternative strategies for controlling the consequences of risk and their impact on the organization must be developed.

e. These strategies must be integrated into the general decision framework of the organization.

Management activities associated with this process will include risk identification, risk evaluation, risk control and risk monitoring. Risk control involves selecting and implementing the solution most appropriate to achieving the given objective while risk monitoring focuses on determining the outcomes in order to assess the validity of the decisions made. Risk management must take place at all levels in the organization.

In determining the cost of risk, in order to measure the effectiveness of a risk management programme, factors such as insurance premium costs, retention costs such as risk control expenditure, maintenance programmes, training costs, fire protection, security and administration costs must all be taken into account. An optimum risk management solution will maintain a balance between the cost of risk improvement and the level of risk financing with the objective of achieving lower levels of risk in conjunction with greatly reduced overall levels of expenditure as shown in figure 1.

In accomplishing these objectives, a means of acquiring and analyzing comprehensive and detailed loss statistics in order to determine the impact of risk management decisions and to identify problem areas requiring attention, is highly desirable. In fact, it is unlikely that the full long term benefits of a risk management program will be achieved unless the risk management program is supported by a comprehensive information system capable of recording all relevant loss information in a manner that supports comprehensive analysis and enquiry.

FIGURE 1 : DETERMINING THE COST OF RISK

2. DEFINITIONS

In discussing risk management in the context of designing and implementing a solution, the following terms are applicable (Valsamakis, Vivian, du Toit, "The Theory and Principles of Risk Management" 1992).

a. Risk management

Risk management comprises a comprehensive range of activities for dealing with risks. As a science it identifies the methods that can be adopted to handle risks and to show the interdependence between the available alternatives. As a management function, it is used to plan, direct and coordinate activities in the pure risk area.

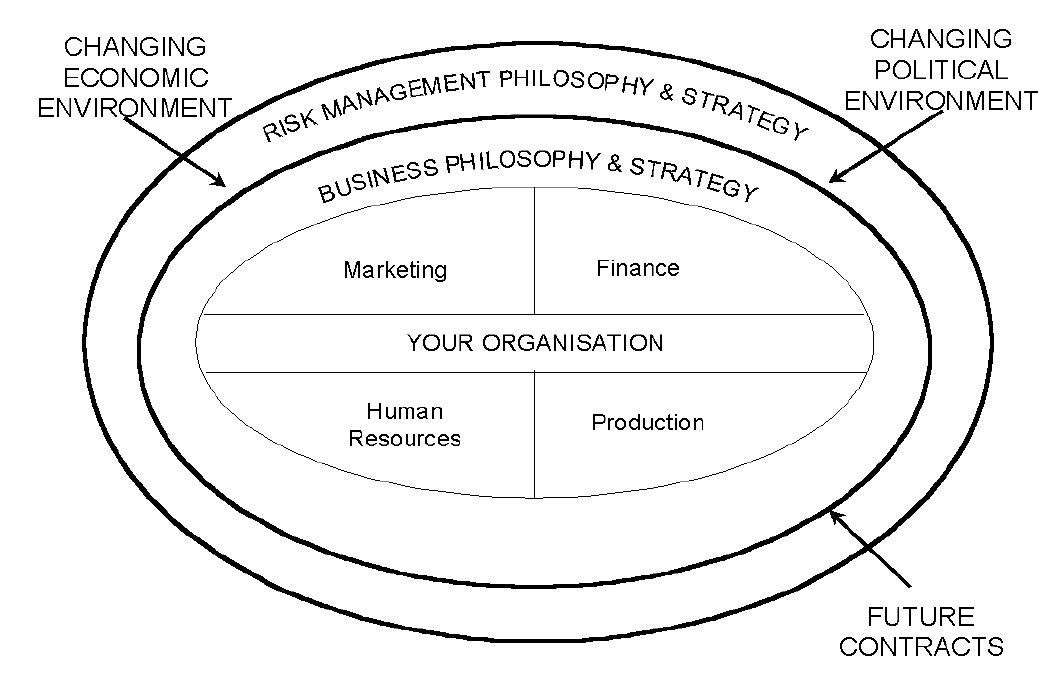

Figure 2 illustrates the relationships between business strategy, risk management and external influences.

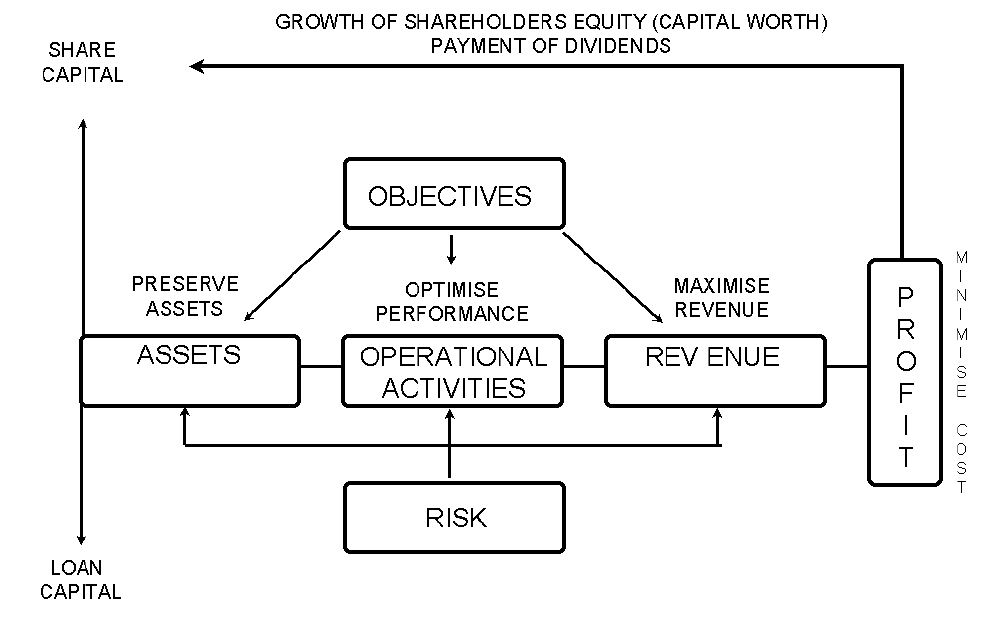

Figure 3, based on the work of the Society of Risk Managers, illustrates the areas covered by risk management and the overall objectives of an organisation.

b. Pure risk

Pure risk is a risk which results only in loss, damage, disruption, injury or death with no potential for gain, profit or other advantage.

c. Risk control

Risk control comprises the provision of appropriate levels and standards of protection for people and assets to avoid, transfer, control of or acceptance of the pure risks which have been identified and evaluated.

d. Risk financing

Risk financing involves the provision of funds for recovery from potential losses that do occur.

e. Risk evaluation

Risk evaluation is the expression of identified pure risks in an organisation in quantitative / qualitative terms in order to gauge the potential severity and frequency of occurrence of these risks.

f. Risk identification

Risk identification is the identification of the pure risks to which an organisation is or could be exposed.

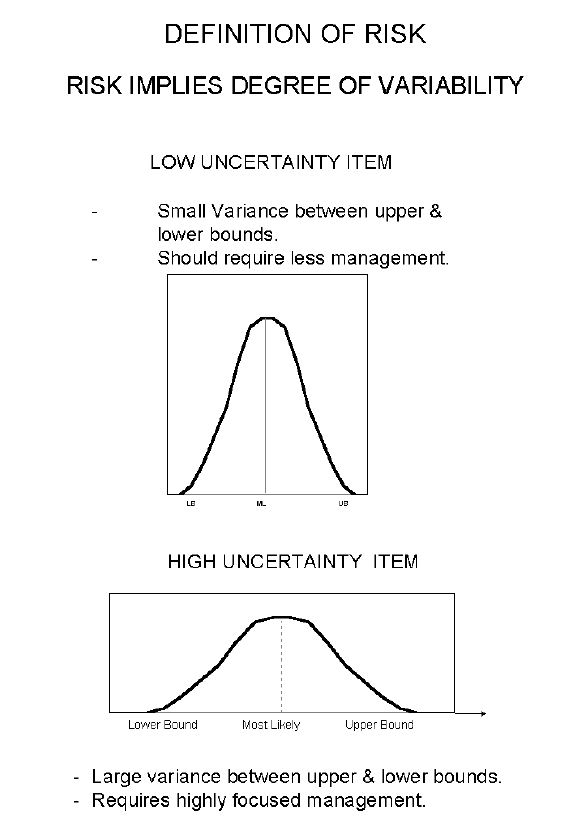

Risk can be defined as the difference between what is expected and what is experienced. In figure 4 item (a) has a greater uncertainty than item (b) and there is therefore a greater probability that the outcome of item (a) will deviate significantly from the expected value with the resultant impact on operations and severity of loss.

g. Pure risk improvement techniques

Pure risk improvement techniques are those techniques which are used to provide appropriate levels and standards of protection for people, assets and earnings. The four main techniques are as follows:

Avoidance - taking action so as not to incur the risk in the first instance.

Retention - acceptance of the risk in its current make-up or character.

Transfer - insurance, non-insurance or contractual transfer of the consequences of risk.

Control - reducing the risk by controlling its frequency and its severity.

h. Risk finance

Risk financing is intended to provide funds to assist the business to survive and recover from losses that do occur. The two main risk financing components are internal and external financing.

FIGURE 2 : THE RELATIONSHIPS BETWEEN BUSINESS STRATEGY,

RISK MANAGEMENT AND EXTERNAL INFLUENCES

FIGURE 3 : AREAS COVERED BY RISK MANAGEMENT AND THE

OVERALL OBJECTIVES OF AN ORGANISATION

FIGURE 4 : DEFINITION OF RISK

3. PHYSICAL FACTORS GIVING RISE TO EXCESSIVE RISK

Traditionally, the focus of risk management has been on the recording and reporting of claims as they relate to insurers. As a management tool, this did not really identify the real risk exposure of the organization. The tendency today is to focus on the overall cost of risk in an organization which is not only the insurance related cost of risk.

Physical factors that can exacerbate risk are diverse and include maintenance issues, health, environmental and other issues. A few aspects are discussed below.

The maintenance of complex plant, particularly in the production environment is often undertaken on a basis of maintaining the most visible items rather than on maintaining those items that have the greatest potential to give rise to losses or increase risk. For example, a decision to save money on the price of a valve or other low cost component can give rise to greatly increased down-time or even catastrophic failure of the plant. Most maintenance programs do not take account of these factors. An effective risk-focussed maintenance management system will focus on the loss implications of failure of a particular component and prioritize maintenance accordingly. This approach requires a different mind-set in the maintenance department and the provision of appropriate tools to enable the maintenance manager to allocate maintenance resources according to the loss implications of failure rather than traditional criteria. Sophisticated computerized information systems are required in order to accomplish this objective.

In practice, it is not uncommon for losses to result from apparently unrelated circumstances. A recent example involved a major transport operator where it was found that a disproportionate number of drivers suffered from diabetes and that their blood sugar levels were dropping in the afternoons as a result of inadequate diet to a level where serious accidents were more frequent than the industry norm. In another case, drivers were waking at 1 am in order to get to work on time and were losing concentration by mid-morning as a result of exhaustion. Many of these situations are never identified or are only identified in response to a decision from insurers to increase premiums because of poor claims history.

With appropriate information systems it is possible to monitor loss experience and identify unusual trends at an earlier stage. Under certain circumstances, it is also possible to identify relationships for more direct investigation thus reducing the time required for manual investigations.

4. INFORMATION NEEDS IN ORDER TO IDENTIFY TRENDS FOR PHYSICAL RISK CONTROL

Experience has shown that major incidents are normally preceded by a number of minor incidents over a period. Typically, such minor incidents do not attract attention and, in many cases, are not reported so that their occurrence is only highlighted during the investigation that follows the major incident. Appropriate use of a loss information recording system will enable these trends to be highlighted in terms of aggregate cost of risk, frequency of occurrence, etc. Such a system will also enable management to track the full scope of losses occurring and in some cases may highlight that the real cost of small losses exceeds the cost of the high profile losses which constitute the normal focus of attention.

Conventional loss reporting concentrates on the amount claimed from insurers rather than the hidden costs associated with the loss which includes down-time, management time, lost production, lost market opportunities, customer dissatisfaction, unremunerated overtime, staff dissatisfaction and other factors.

Compounding the above difficulties, it is frequently found in many organizations that the personnel responsible for risk control and risk improvement rarely communicate with the personnel responsible for making the financial decisions regarding insurance and self-insurance levels. In order to make strategic decisions with regard to the financial component of risk management, there is a clear need for organizations to restructure these functions resulting in a single line of responsibility for all risk related management as indicated in Figure 1. Tightly integrated risk management information is a vital component for achieving this objective.

In order to fully accomplish the objectives set out above, it is necessary to establish effective communication between the risk improvement and financial functions in order to ensure an integrated approach to risk management. The effectiveness of this communication can be greatly enhanced by having systems which will enable the full financial implications of past losses to be reported thus enabling the full implications of proposed risk management decisions to be accurately projected. This will, in turn, give rise to far better decisions with a long term impact on the profitability of the organization.

A prime requirement indicated by the above discussion is the need for a single integrated database of all risk related information in order to support a single basis of risk related decision making. In addition to information pertaining to incidents that occur, this database should include planned maintenance information, risk audit statistics, information about unaccounted losses, (those losses normally recorded elsewhere but which contribute to the cost of risk such as wear and tear) and other statistics normally recorded separately.

As an example, an organization involved in the introduction of ISO 9000 certification concluded that they were not being particularly effective in their maintenance programs. It was therefore decided to create a database of all major items such as boilers, pressure vessels, etc as well as all other equipment and to associate this database with a database of all relevant legislative requirements. Based on this database, maintenance of all plant and equipment was prioritised and scheduled and it was found that, whereas when the idea was first mooted, increased costs were anticipated, the overall cost of running the plant was reduced and plant efficiency was increased.

5. THE BENEFITS OF ESTABLISHING AN INTEGRATED LOSS DATABASE

The business case in favour of establishing an integrated loss database has been set out above, some of the benefits of such a database are listed below:

a. An integrated loss database will make it possible to introduce a holistic and consistent risk improvement program across the organization in order to enable a standardised approach to be adopted toward financial, and physical risk management.

b. Accountability for losses and risk management can be effectively established by incorporation of an appropriate business model and business rules into the database in such a way that every item can be uniquely associated with a single responsible person who has final accountability. Consideration of these factors during the implementation of the system will frequently cause the organization to identify issues for which accountability has not been effectively defined.

c. The true cost of risk, including hidden costs and high frequency, low value, unaccounted losses, can be established so that management can adopt a pro-active approach centred on reducing the total cost and not only the visible cost.

d. The quality of pure risk management will be greatly improved and duplication of effort will be avoided.

e. Early identification of adverse trends will minimize the probability of the occurrence of catastrophic loses and improve the ability of management to isolate those aspects of business operation that are most at risk of catastrophic loss. This in turn will enable informed decisions to be taken with regard to the need for disaster recovery and business continuity.

f. Accurate centralized information will simplify risk management and reduce risk management costs for comparable results or, more importantly, give rise to a greatly improved return on the risk management investment.

g. Accurate loss and risk management information, centrally available, will give rise to more effective decision making and enable management to see "the big picture". A well designed information system will also support distributed operation so that unit, plant, regional and corporate management will all have access to the components of the database of relevance to them. This will also enable management to benchmark similar business units across the organization in order to identify favourable and unfavourable trends in certain units. This has the potential to greatly improve the dissemination of information with regard to risk management practices that are delivering particularly noteworthy returns.

h. These facilities will also greatly enhance the ability of risk managers at all levels to adopt a coordinated approach to risk management.

i. By providing effective summarization and drill down capability, it will be possible for management to focus on the key issues in risk management within the organization at any time.

j. An effective risk management information system will also provide the tools necessary to ensure that insurance policy endorsements and limitations are constantly monitored thus greatly reducing the risk of policies being revoked due to non-disclosure or other considerations. A comprehensive risk management information system will include policy information at a level that allows full insurance policy management including aggregate management and other funding factors to be taken into account.

6. CONCEPTUAL REQUIREMENTS FOR THE IMPLEMENTATION OF AN EFFECTIVE RISK MANAGEMENT SYSTEM

Paton (1993) has discussed in detail the requirements for implementing a risk management system while Robertson (1992 1&2 and others) have discussed the implementation of computerized information systems. These publications and other work undertaken by the authors comprehensively document the approach necessary to undertake a project of this nature.

In summary, the requirements for the implementation of an effective risk management system include the following:

a. Develop a risk exposure profile of the organization.

b. Identify core business activities impacted by risk management.

c. Analyze past losses and loss trends.

d. Determine market factors influenced by risk exposure.

e. Integrate risk management with business strategy and introduce a program to make risk management part of the corporate culture.

f. Address environmental issues as part of the cost of risk.

g. Restructure the risk management and risk finance functions of the organization.

h. Implement a centralized loss information acquisition system and database and associated risk management information system.

7. CASE STUDY OF AN IMPLEMENTATION PROCESS

A major South African corporation which had previously self-insured all losses recently undertook the introduction of a comprehensive risk management program including the implementation of an integrated risk management information system addressing many of the aspects discussed in this paper. The information system implemented was the prototype of a more comprehensive system proposed for future development. The system was developed and implemented in late 1992 and has been successfully used since then to acquire comprehensive loss statistics and as an information base for introducing comprehensive risk management and risk financing practices throughout the organization.

The system is currently being used to process in excess of 10,000 loss incidents from five regions around the country using four operators. With the statistical base that has now been developed, the basis of risk funding between insured, self-insured and uninsured losses is being optimized and a comprehensive risk improvement program is being implemented. The system is also being used to monitor the progress of insurance claims submitted. It is estimated that a staff of about 12 would have been required to process the same information using conventional techniques without providing any of the management information that the computerized system makes available. Major enhancements to the system are envisaged based on experience to date with the objective of developing a commercial software system aimed at the corporate market.

8. CONCLUSION

A wide range of factors applicable to risk management with particular emphasis on the management of the physical factors contributing to risk have been discussed. The need to directly associate the financial implications of losses with the physical factors giving rise to risk is identified as is the need to record losses which are traditionally not accounted for. It is concluded that this can only be effectively accomplished using a comprehensive, integrated loss database and computerized risk management information system. Some of the benefits of this approach and conceptual considerations are addressed and brief case histories are presented.

It is concluded that the effective management of risk in organizations in a manner that will produce significant improvements in loss reduction will also give rise to significant improvements in operational efficiency and substantial overall profitability improvement. These benefits will only be achieved if an holistic approach to risk management and risk finance is adopted that takes account of hidden, as well as visible costs and is associated with a restructuring of the risk management and risk finance components into a single area of accountability. The application of leading edge information technology is a vital component of this solution but must be associated with practical and effective implementation within the organization.

FOOTNOTE

CRM Risk Control Consultants is a firm of specialist risk management consultants within the Price Forbes Group of Companies which specializes in providing a comprehensive risk management consulting service to clients. CRM Risk Control Consultants can be contacted on (011) 637-2148.

Differentiated Strategic Solutions (dS2) is a firm of independent business information system specialists concentrating on offering information systems consulting, software development services and strategic software products with particular emphasis on the fields of decision support and management information. They place particular emphasis on innovative solutions which enable clients to create and sustain competitive advantage and on the effective implementation of such solutions and have been involved with CRM in the development and implementation of the information system on which the case history is based. Through associates in The MaXus Group and other associated specialists they are able to provide a wide range of additional consulting and other services. Differentiated Strategic Solutions can be contacted on (011) 886-9863.

The contribution of our clients and associates without whom we would not have had the opportunity to evolve and develop these concepts is gratefully acknowledged.

REFERENCES

Robertson (1992(1)) Effective Implementation of Executive Information Systems. Paper presented at Executive Information Systems Conference, Johannesburg, March 1992.

Robertson (1992(2)) Enhancing Information System Effectiveness: The Human Element. Paper presented at Executive Information Systems Conference. Johannesburg, March 1992.

Robertson (1994(4)) A Practical Approach to Implementing Integrated Information Systems in Real Companies. Paper to be presented at SAICE IT Division Conference on Integrated Information Solutions in Engineering Practice, Johannesburg, October 1994.

Valsamakis, Vivian & du Toit (1992) The Theory and Principles of Risk Management. Butterworths.

22 to 23 June 1994

Download the CRM Risk Control: Designing and Implementing an Integrated Risk Management System -- Article in Adobe pdf format

018 Designing and Implementing an Integrated Risk Management System that Effectively Minimizes your Exposure -- CRM Risk Control Case Study -- by Dr James A Robertson PrEng from James Robertson

Download Designing and Implementing an Integrated Risk Management System that Effectively Minimizes your Exposure -- Slides in Adobe pdf format

Download Designing and Implementing an Integrated Risk Management System that Effectively Minimizes your Exposure -- Paper in Adobe pdf format

Section 8.3

Rennies Group General Ledger case study -- headlines

The headlines of the Rennies Group General Ledger case study are as follows:

1. Group consolidation general ledger solution

2. 220 companies of great diversity from Travel to Foreign Exchange to Fishing Trawler Fleet to Trading to Sugar Terminal to Vehicle Rental, etc

3. Established fundamental drivers across the entire Group

4. Group wide view of high level financial performance

5. Dramatic increase in management information

6. Presentation with client – greatest recommendation

Information Architecture and Design of FIS

Rennies Group Limited Case Study

Financial Information Systems Conference

By Kerstin Speer CA(SA), Group Financial Manager, Rennies Group Limited and Dr James A Robertson PrEng

SYNOPSIS

The background to the introduction of a Group-wide financial reporting and management information system for Rennies Group Limited (RGL) is outlined in the context of current thinking on the application of Financial Information Systems (FIS). The status of the Rennies Reporting System (RRS) at the time the decision was taken to develop an information architecture and design is summarized.

The desired components of a three year FIS strategy are presented together with the FIS strategy already in place at RGL.

Considerations with regard to the implementation at RGL are given with particular reference to the fact that a clearly defined customer focused business strategy was already in place and that an EVATM programme was underway.

The procedure followed in undertaking the information architecture and design of the Rennies Group consolidation Master Chart of Accounts included extensive involvement of users and management, definition of a generic, structured business information classification scheme and building a framework to support future development. It is noted that provision is made for a future business model to be developed which will support full cascading of the chart of accounts down to the operational business unit level while maintaining the integrity of the consolidation process. Also revenue and cost driver classification was undertaken in a manner that was independent of individual business units and which will support restructuring, acquisitions, mergers and divestments in the final form of the business model.

A conceptual framework for inter-region, branch and subsidiary analysis has also been laid.

The manner in which RGL has integrated existing systems is outlined with particular reference to the upload of the financial intelligence of the software to assist with integration is described. The importance of the information architecture in achieving this objective is highlighted.

The benefits of implementing FIS are outlined and it is noted that certain flagship operations have leveraged the capabilities of the solution by moving their management reporting function onto the new system while it was still in pilot operation. These sites achieved considerable improvement in analysis and reporting capability with a resulting time saving that was used to free financial personnel up to undertake more effective analysis.

A summary of the benefits that RGL has obtained from FIS strategy is provided and it is noted that the current project has laid the foundations for a long term process of progressively improving management information delivery and decision support within the Group in a manner that has the potential to enable the Finance Function to add considerable value to the operating entities.

It is concluded that effective information architecture and design is vital to ensuring a return on investment in FIS and that, if this is correctly undertaken and implemented, it will enable the Finance Function to add considerable value to the organization at all levels.

1. INTRODUCTION

The concept of Financial Information Systems is well established as a result of many conferences and other development. Robertson has addressed a number of aspects of this subject, most recently at the Financial Management Information Systems Conference, held in Midrand in September 1994 at which a paper entitled, Identifying Your Key Business Objectives to Develop a Coordinated FMIS Strategy that Meets Your Specific Needs was presented. As a result of the presentation to this conference, it was decided to introduce some of the concepts addressed in the presentation into the "Rennies Reporting System" (RRS), which was currently being planned.

RRS is a group-wide consolidation and reporting system using a commercial consolidation product, Hyperion. RRS objective is to consolidate information from the approximately 220 operations in the Rennies Group up to Group Head Office in Johannesburg in a manner that will support Group reporting requirements and support the overall business strategy of the Group. This paper presents some of the concepts applied in the project to date in the form of a case study.

As noted above, the solution was implemented using commercially available software. This was installed on a client-server database platform. The subject of this case study is therefore not the design or selection of a software and technology solution but the information architecture and design of the business solution implemented using the product selected. It is hoped that this paper will serve to draw readers attention away from technology and cause them to focus on the business design issues surrounding the use of Information Technology (I.T.) in general and FIS in particular.

2. WHAT SHOULD FIS STRATEGY ENTAIL

Robertson, in the paper referred to above, recommends that a three year FMIS strategy should incorporate the following:

a. Determine broad business objectives.

b. Determine what financial information is required in order to give effect to these objectives

c. Determine what financially related business concepts should be introduced or enhanced in order to meet these objectives in support of improved management decision making.

d. Evaluate the fundamental changes to financial operating procedures and systems required to support the objectives including:

i. First principles analysis of financial systems and coding systems.

ii. First principles analysis of the business model incorporated into the financial systems to support unambiguous ownership.

iii. Comprehensive review of up-stream and down-stream controls on the flow of information in the FIS.

iv. Evaluation of implementation considerations with regard to system acceptance.

e. Investigate use of multiple bases of accrual.

f. Develop overlay ledgers for different levels of adjustment, such as EVA.

g. Develop a culture of future focused management applying these concepts to create and sustain competitive advantage in a manner that truly adds value to the organization.

h. Consider the extension of the FIS to become part of a "Corporate Command Center"

This approach to FIS strategy is the vision of the Rennies Group and has the commitment of management. It also has the potential to truly differentiate the organization.

3. RENNIES GROUP IMPLEMENTATION CONSIDERATIONS

In the case of Rennies Group Limited (RGL), the project was undertaken as an extension of an existing project which was already underway. In particular, RGL had already clearly defined its strategic objectives as a customer focused service organization and had appointed Stern Stewart and Company to implement a comprehensive Economic Value Added (EVATM) program. In addition, the technology platform and software for the RRS had already been selected and a project plan had been drawn up.

The implementation was therefore undertaken on a limited scale with emphasis on first principles analysis of the information classification schemes and coding of the Group Consolidation Ledger to support the great diversity of businesses in the Group. The group ranges from well-known operations such as Rennies Travel, Rent a Bakkie, Renfreight and XPS to less well known trading and freight management businesses such as Manica which operates throughout Southern and Central Africa.

Basic consideration was given to conceptualization of the business model and overlays for management accounting purposes but these will be designed in detail as part of a later phase of the project.

Implementation was undertaken by way of a multiple pilot site deployment in terms of the original project plan under the guidance of Group Information Services.

Accordingly, this paper concentrates on the information architecture and design of a Group Consolidation Chart of Accounts to serve the full diversity of companies within the group.

4. INFORMATION ARCHITECTURE AND DESIGN OF THE GROUP REPORTING GENERAL LEDGER CHART OF ACCOUNTS

Design was undertaken by way of a series of workshops with senior financial and operational managers of the larger divisions and companies within RGL. During these workshops, the following was achieved:

a. Widespread consultation with senior end users.

b. Development of a clear understanding of the diversity of businesses within the Group with a particular emphasis on determining business unit independent definitions of Revenue Drivers and Cost Drivers in a manner that would enable a generally applicable chart of accounts to be developed which would accommodate any change in organizational structure, including acquisitions, mergers and divestments.

c. Design of a highly structured information classification scheme that supported full hierarchical analysis and drill down within the guidelines given by Robertson (19949 and others).

d. A design that supported both disbursement and expense orientated operations.

e. A framework to support monthly, year-end, tax, management and EVA reporting requirements, amongst others.

f. A clear understanding of the business model that should be implemented.

g. Conceptual definition of a framework against which inter-region, inter-branch and inter-subsidiary analysis could be implemented at a later stage. This also provided a conceptual framework for definition of a market sector input : output analysis at the financial level.

h. Definition of a solution that could be "cascaded" through the Group to individual operating companies and eventually to SBU level.

i. Definition of a solution that would provide the foundation for business modelling and a broad based "Executive Information System" (EIS) at a later date in a manner that would enable Group Finance to add considerable value to individual operating companies in time.

The information architecture and design of the RRS Chart of Accounts was spread over a period of approximately two months with a high level of involvement from the Group Financial Manager, Project Manager, Consultant and other team members throughout this period. Approximately ten workshops of from two to eight hours duration were held with users and management of groups of subsidiaries and individual companies. Further project meetings took place throughout the period. The end result was a consolidation chart of accounts with approximately 700 posting level accounts suitable for implementation across the entire organization at a business unit level.

5. HOW RENNIES GROUP LIMITED HAS INTEGRATED EXISTING SYSTEMS

Existing general ledger systems were integrated in the following way:

a. Existing general ledger charts of accounts were mapped onto the Hyperion consolidation chart of accounts in paper mapping exercises facilitated by the project team.

b. ASCII upload files were generated from the existing systems in a format that could be uploaded into the Hyperion software.

c. The functionality of Hyperion permitted a direct link between existing systems such as Accpac, Accountability and Millenium through account conversion and name conversion tables.

d. The upload used as building blocks groups of accounts classified into categories including:

i. Income statement accounts (revenue, disbursement and expense).

ii. Balance sheet accounts (intangible assets, assets, liabilities).

iii. Reporting accounts such as cash flow and budget.

iv. Balance and control accounts.

v. Non-financial, derived and other information for purposes such as tax, year-end, EVATM, etc.

e. A basic business entity model was implemented in order to provide systematic consolidation into Divisions and from Divisions to Group. This model reflects the organizational structure of the group.

f. Separate input and adjustment entities are defined for use in different stages in the process.

g. Input ledgers are maintained in the currency of origin and foreign currency translation takes place at the appropriate location in the organizational structure.

h. Reporting is performed using the reporting capabilities of the tool used together with dynamic linking to the Microsoft Excel Spreadsheet package.

The project team is currently busy with the deployment of the application to further sites and the extension of the application to more fully support all aspects identified.

Business modelling, market modelling, geographic analysis and the introduction of an EIS are scheduled to take place in the second half of the year.

Effective integration was made possible by the structured financial information classification contained in the Master Chart of Accounts referred to previously. This structure ensures that, while individual subsidiaries may apply different accounting treatments with regard to aspects such as disbursements, the Group consolidation figures are based on a uniform treatment which accommodates the diversity of business operations.

6. BENEFITS OF IMPLEMENTING FIS

While the RRS system will only run live from 1 July 1995, it is currently in use for budget purposes for the 1995/96 financial year. It is currently deployed at the Divisional Level as well as at 18 major operations.

Benefits that are anticipated from the RRS include a saving in the production of the Group Tax statements of approximately three weeks at year-end, a saving in producing the year-end pack of approximately two weeks together with a considerable reduction in reconciliation and manual reprocessing effort. A monthly saving of 3 days per month at Group Level in producing consolidated Group Financial Reports is anticipated.

It has been found that all operations have been able to map their existing general ledger accounts onto the consolidation chart of accounts successfully, although individual entities have experienced some difficulty where more detail has been requested than they are accustomed to providing.

More tangible benefits have been experienced at certain pilot sites where enthusiastic and proactive involvement by financial management and the executive of the companies concerned has resulted in the full potential of the system being realised. In one notable case, a subsidiary moved it's management reporting off their existing bureau based general ledger systems onto the new system while still in the pilot stage because of the greatly improved reporting capabilities of the new system.

In this case, the time saving resulting from improved ease and effectiveness of reporting has been beneficially utilized in undertaking more detailed analysis in support of management effectiveness. This is expected to give rise to better decision making with regard to branch viability and competitiveness and an increase in market share is projected as a result.

In another notable case, a one-to-one link between the existing general ledger system and RRS has created a powerful reporting tool which is exploited fully by this operation. Furthermore, by efficiently using the name structure capabilities of the tool, reporting of profit centres by region, product type and executive is simple and flexible and is empowering the user in preparing financial information.

In flagship cases such as the above sites, a major benefit to Group Finance has been an opportunity to be seen by subsidiaries to be adding value to the operations of the Group. This demonstrates the potential synergy of a forward thinking central Group Finance Department anticipating the decision support information needs of subsidiaries.

7. WHAT HAS RENNIES GROUP LIMITED GAINED FROM FIS?

The expected benefits of the RRS FIS and those experienced to date are set out in the preceding section.

In addition, Rennies Group has gained a platform on which a wide variety of value adding services can be delivered by Group Finance and financial management of individual operating companies. This business solution platform provides a basis on which:

a. Improved Group reporting can be built.

b. A corporate business model can be implemented.

c. Group-wide EVATM analysis and reporting can take place.

d. Reporting of Key Performance Indicators (KPI's) including non-financial components can be undertaken.

e. Regional and market based analysis can be designed and implemented

f. Improved reporting effectiveness at the operational level and improved management decision support.

Significant further analysis and design of the business model and other components referred to above will be required before these can be implemented. Much of this is planned for the second half of 1995.

8. CONCLUSION

The background concepts and business environment surrounding the Rennies Reporting System have been outlined together with major considerations taken into account in the information architecture and design of the system. Particular emphasis is placed on the importance of effective information classification and the approach adopted in developing a Group-wide Master Chart of Accounts is set out in some detail.

Principal strategic considerations and factors to be taken into account in planning the FIS project have been summarized.

Certain initial benefits experienced by Rennies Group Limited, including dramatic improvement in financial management reporting capability of flagship sites are outlined. Other expected benefits are summarized. Opportunities to develop market focused analysis and reporting capabilities are identified as a particularly important component of future opportunities.

It is concluded that effective information architecture and design of an FIS can give rise to significant benefits and are vital if the Finance Function is to be seen as adding value to the organization.

ACKNOWLEDGMENTS

The support of the management of Rennies Group Limited and their permission to publish this paper is gratefully acknowledged as is the contribution of all members of the project team.

The contribution of dS2's clients, associates and staff, without whom it would not have been possible to evolve and develop these concepts is gratefully acknowledged.

FOOTNOTE

Rennies Group Limited is an investment and management company in a multi-business netork focusing on freight management, travel and other related services. The Group provides resource backing to autonomous operating companies operating in Southern Africa through ownership and internationally through alliances.

Rennies Group Limited is jointly controlled by two major South African corporations, namely Safmarine and Rennies Holdings Limited and Anglo American Industrial Corportion Limited.

The Rennies Group has operated in Southern Africa for 146 years and is a regional force in the transport services industry. Employing some 10,200 people, Rennies offers in excess of 30 different services through more than 350 locations in eight countries in Southern and Central Africa.

The Group's current strength and future strategy linges on three crucial factors:

- A single-minded focus on managing the movement of people & freight.

- The depth of its skills.

- The breadth of its network.

Differentiated Strategic Solutions (Pty) Ltd is a firm of independent business information system specialists, management consultants and software developers. They are able to provide the full range of professional services necessary to architect, design and implement financial information systems and to integrate existing systems including all aspects outlined in this paper.

Particular emphasis is placed on aspects of design and implementation necessary to improve business process and maximize information return on investment. Products and services include the information and systems architecture, design and implementation of financial information systems from a fundamental first principles basis, the conceptualization, specification, construction and implementation of integrated information systems, enterprise information systems (EIS), corporate command centres and other business information systems.

They also offer a range of services with regard to strategically focused financial management information determination and linking financial planning to business strategic and macroeconomics in terms of the capability of the balance sheet and economy to sustain strategic objectives. System audits, development of IT strategies and business system feasibility analysis are other services.

Together with associates in The MaXus Group and other associated specialists they are able to provide a wide range of additional consulting and other services in support of the concepts outlined in this paper extending to comprehensive Business Process Optimization services applying techniques developed through an international network of expertise. dS2 can be contacted on Johannesburg 886-9863 or fax 787-0132.

REFERENCES

Robertson, J A (1994) Identifying Your Key Business Objectives to Develop a Coordinated FMIS Strategy that Meets Your Specific Needs Presented at Financial Management Information Systems Conference, Midrand, September 1994.

30 to 31 March 1995

Download the Information Architecture and Design of FIS for Rennies Group -- Article in Adobe pdf format

026 Information Architecture and Design of FIS -- Rennies Group Limited Case Study -- by Dr James A Robertson PrEng from James Robertson

Download Information Architecture and Design of FIS -- Rennies Group Limited Case Study -- Slides in Adobe pdf format

Download Information Architecture and Design of FIS -- Rennies Group Limited Case Study -- Original Paper in Adobe pdf format

Section 8.4

African Sales Company case study -- headlines

The headlines of the ASCO ERP Implementation case study are as follows:

1. James Robertson as Project Leader and Strategic Advisor on turnaround of stalled project

2. Comprehensive taxonomies

3. "A strategic resource"

4. Hard lessons learned about level of rigour required

5. Unexpected benefits relating to data precision

6. High level of ownership by the client

7. Paper co-authored by CEO of Client – greatest recommendation

Doing things differently and better

ASCO Case Study 2

BPM Summit 2013

1. Overview of the business – marketing and brand management

African Sales Company is a moderate sized family owned business that imports and distributes fragrances, perfumes and related products. They also provide a brand management service to their suppliers and distribute fine fragrances and luxury cosmetic brands like Dior, Givenchy, Gucci, Dolce and Gabbana, Paco Rabanne, Carolina Herrera, Prada, Calvin Klein, Hugo Boss and others to retail vendors like Edgars, Foschini, Truworths, Stuttafords, Woolworths, Dis-Chem and others. ASCO does this with prescribed service levels aiming at 98% fill rates and three day delivery times from receipt of EDI orders to goods being available at retail points.

In order to understand the business it is vital to understand the close juxtaposition of brand management and distribution.

2. The challenge – overview of the situation before the investment

The challenge that gave rise to this project was an old customized software suite that had grown with the business on a tight budget. The accounting with regard to brand related costs was handled by more than 20,000 accounts in the General Ledger. Other aspects of Brand Management were manual. Tracking costs and reporting on many brands to multiple Suppliers was a major challenge.

3. The opportunity – implementing a new ERP and Warehouse System taking a strategic view

A point was reached where a new system was required and an integrated suite of ERP and Warehouse Management System was purchased. Initially a comprehensive workflow (process) analysis was undertaken but the project stalled. The project was then restarted with a strong strategic and precision configuration focus with tight project management and successfully brought to completion – the process maps were left on the shelf.

During the project it was identified that areas of the business that would benefit from a new approach – particularly relating to brand management expense allocation and a custom solution was conceptualized, designed, built and implemented in order to maximize the effectiveness of brand management.

4. The solution – highly structured Product Class, integration with Projects Module, custom software

The total strategic solution comprised:

a. The Brand Hierarchy – a highly structured Product Classification of all products linking from Suppliers down to individual Brand Lines – this created a high value logical information platform that underpins every aspect of brand and business management;

b. A selection of fundamental highly structured custom product attributes that have opened up diverse strategic intelligence and analytical opportunities;

c. Intelligent Product Master maintenance that draws on the intelligence in the Brand Hierarchy and attribute lists to ensure that default values are cascaded down the hierarchy so that new product take-on generates high quality intelligent data that impacts every aspect of system operation and management information;

d. Rule based automated creation of Marketing projects linked directly to the brand hierarchy coupled to a highly structured cost taxonomy provided a comprehensive framework for Brand Management information. This custom functionality, based on knowledge of the codes, opens the door for convenient and powerful marketing planning, cost analysis and reporting;

e. All of these components taken together have created a holistic and integrated intelligent information platform that has resulted in the business now having a much stronger analytical focus, capability and culture.

5. The outcome – greatly improved brand management and other capabilities supporting profitable growth and competitiveness

Taken together this capability improved expense allocation accuracy, allowed detailed ROI analyses, increased competitiveness through informed allocation of resources, facilitated growth and stimulated profitability in significant measure through the investment in strategic precision configuration and associated custom development. This capability assisted ASCO to grow significantly, take on new accounts and reach a point where a new distribution centre became a business necessity such that a new warehouse is currently in the design phase.

Associated with this capability has been the development of a highly analytical culture which has positioned ASCO as an industry leader in the management of information and therefore Brand Management in its specialized category.

It should be noted that as a consequence of the development of these capabilities there have been further changes to practices and ways of working (processes) which have flowed organically from the original analysis and decision making capabilities.

Download the ASCO Case Study -- Creating Competitive Advantage -- Priebatsch and Robertson -- Presentation in Power Point pptx format

Download the ASCO Case Study -- Creating Competitive Advantage -- Priebatsch and Robertson -- Slides in Adobe pdf format

Download the Doing things differently and better -- ASCO Case Study 2 -- Article in Adobe pdf format