TxM 046 Section 5.1 The JAR&A SEPT Cubic Business Model and Group-Wide Chart of Accounts Created by James on 7/4/2013 10:52:12 AM

One of the cornerstones of the JAR&A Strategic Engineered Precision Taxonomies approach is the Cubic Business Model which, in turn, relates to the Group-Wide Chart of Accounts.

This section discusses this particular component:

1. Our flagship SEPT offering based on 22 years of experience built on 1,000 hours of R&D – huge opportunity

In 1987-88 I was directly involved in the design, construction, testing, commissioning and implementation of a fully integrated "Management Information System" for the firm I worked for. The system included fully integrated Debtors, Creditors, General Ledger, Work in Progress and Time Based Billing and Management. In today's terms it was a fully-fledged ERP.

We designed the entire solution to be tightly integrated at the data level and created a seamless integration that has gone on to underpin the dominant specialist ERP in the Consulting Engineering fraternity in South Africa, "ProMan" – which stands for "Professional Practice Management Information System" and which is installed in over 70 firms including many of the largest.

We struggled for weeks to get the General Ledger integration to work exactly the way we wanted and spent many late nights ticking transactions until eventually we discovered that there were some very rigid technical rules underpinning the geometry of financial data in terms of location – function – account and that, unless one got these dimensions absolutely precisely defined the full richness of the integration was not achieved.

We incorporated the findings into the software design and it has operated reliably ever since with what is probably still the tightest integration I have ever seen in the ERP space, and I have seen dozens of ERP implementations across the full spectrum of brands.

In 1989 I left the Engineering firm concerned and set out on my own with the objective of bringing "the disciplines of engineering to the Information Technology (and by extension ERP) industry".

As I have described elsewhere this was the start of a long and arduous journey that has brought me to the point where it now finally seems appropriate to write this manual.

In 1990 I was approached by another firm of consulting engineers to assist them to implement the software referred to in their business. Flushed with the success of the previous implementation I confidently quoted for 40 hours of my time to design a Chart of Accounts for their business – which was larger and more complex than my previous employer.

Very aware of the importance of the Cubic Business Model as I started to call it I decided to generate the Cubic Model using spreadsheet macro's.

1,000 hours later I finally hit the button and generated the full Chart of Accounts having learned a whole lot more critical lessons with regard to the effective design of financial data taxonomies.

The lessons learned in this painful period of unremunerated Research and Development have remained with me to this day and the standards and conventions developed then infuse the entire Strategic Engineered Precision Taxonomy and Precision Configuration approach that is discussed at length in this manual.

I have not encountered any other person who has attempted what I achieved in 1990 and I have not encountered anyone else who is fully aware of the underlying principles and complexities that I uncovered at that time and which underpin the whole SEPT approach set out in this manual.

I can therefore say with a high level of confidence that it is improbable that another firm has the intellectual property in this area to create a solution of the strategic robustness and value that is being discussed in this section.

I honestly believe that the SEPT Cubic Business Model and Group-Wide Chart of Accounts approach discussed here is head and shoulders above any other offering that I have ever encountered and that this therefore represents a MAJOR OPPORTUNITY to create strategic value for any significant organization.

2. An integrated governance, leadership, accountability and management model in addition to an accounting model

Inherent in the approach that is advocated as part of the SEPT Cubic Business Model and Group-Wide Chart of Accounts approach discussed here is an integrated governance, leadership, accountability and management model IN ADDITION to an accounting model.

The approach produces a Chart of Accounts that is designed for ease of management application, that ensures high levels of accountability and therefore facilitates ease of delegation and overall improvements in governance by providing precise measures of financial performance for every unit and sub-unit of the business to whatever level of detail is required by Executive Management.

It so happens that this design is ALSO easy to use from an accounting point of view (although it does require significant training and re-orientation of financial operational personnel) AND it is largely self-auditing so that the duration and cost of the audit are drastically reduced in most cases once it is bedded down and operating effectively. This of course assumes that the Chart of Accounts is properly integrated with the ERP with SEPT taxonomies throughout the ERP or Data Warehouse and that all change and other issues are dealt with during the implementation in order to ensure that the tool is used to its full potential.

3. BUT James, you are an engineer – what do YOU know about accounting?

Some years ago the Chief Financial Officer of a client rejected what I was proposing on the grounds that I was an engineer and therefore in his opinion knew nothing about accounting.

At one level he was right, I AM an engineer and I do NOT claim to be an expert on accounting practices, standards, conventions, interpretation of financial statements, etc.

I DO claim to be an expert on information engineering, taxonomies, decision support and other elements that are necessary to ensure that computerized information systems fully support the business in a manner that results in high value implementations.

I hold that one of the fundamental principles of what I term "the engineering approach" is that engineers work in multi-disciplinary teams – for example, it takes about 250 different professional disciplines and trades to design and build a 50 story office building ranging from the senior strategic architect, through the architectural draftsman to the tradesman who lays the carpet.

Accordingly, I hold that it is desirable that I am NOT an accountant – I work closely with the Chief Financial Officer and other financial personnel of client organizations and, where necessary, with the senior partner responsible for their account from their auditors.

I have also designed numerous charts of accounts with diverse clients and therefore have the benefit of insight into different ways of thinking and, the reality is, there ARE different schools of thought in the Accounting fraternity on how things should be done. That is desirable, each business is different and the goal is to craft the best Chart of Accounts for the client organization.

My role is as a facilitator and thought leader in terms of the mechanics of Chart of Accounts design, the Chief Financial Officer, the CEO and other senior executives are the customers for the resulting output and the Chart of Accounts must make perfect sense to them – when they look at the Chart of Accounts I want them to have an "Aha" moment and say "YES, this IS MY business!"

So I support the client to develop carefully thought out hierarchies, make sure the progression of content follows strategic logic, ensure fine granularity of posting level accounts that models the real world and generally make sure that the final product is a high value taxonomy that will serve the organization well for many years to come – I hold that a well-designed and well maintained JAR&A financial taxonomy (AKA Chart of Accounts) should easily last for twenty years or even longer.

I look to the Financial officers of the client, assisted as necessary by their Auditors and other financial advisors in order to ensure that the taxonomy we produce complies with accounting standards such as IFRS, GAAP, etc.

In doing this I have found that provided the level of detail in the Chart of Accounts and the overall model are fine enough compliance with accounting standards is very simple, it just follows automatically from an experienced professional (the CFO) defining his or her information needs in a logical and structured manner assisted by an expert information engineering facilitator.

The same applies to alternative accounting treatments and report groupings such as are necessary to compute EBITDA and other ratios, etc. Once the data is extremely well organized all these alternative accounting forms are easily accommodated, far more easily than with the legacy Charts of Accounts I see in all organizations I evaluate.

Thus, to answer the question, I think it is an advantage to my clients that I am an engineer!

Oh, and by the way, I CAN draw AND interpret T diagrams...

4. Ties the entire enterprise together in a systematic structured manner – a group consolidation model and an integration model

The JAR&A SEPT Cubic Business Model and Group-Wide Chart of Accounts coupled with the full range of JAR&A SEPT hierarchy design and coding conventions provides an information CONTENT mechanism to tie the entire organization together in a logical structured manner that permits "slicing and dicing", "drill-down" and "roll-up" to be done quickly and easily harnessing the FULL potential of whatever investment in Information Technology the client organization has made to this point.

Using this approach your ERP will fly, so will your Data Warehouse and so will whatever query and reporting tools, Business Intelligence tools, etc that you may have purchased.

Even your Excel spreadsheets will be easier, faster and more reliable and all sorts of advanced analyses that currently you may only dream off will become easily and practically achievable.

The Cubic Business Model provides a Group Consolidation model that will accommodate the most complex organization structures through a systematic approach to modelling the real world legal complexity of the organization.

The entire logical solution provides a foundation for tying together all aspects of the integration of your ERP or Business Data Warehouse information in a manner that facilitates drill down from one line of inquiry and drill up into other sources of information – launch an inquiry into the asset costs in the General Ledger and drill up easily into the Assets Register or Plant Maintenance Module to obtain the detailed analysis of well-structured financial AND OTHER information in those modules.

5. Facilitates strategic (thrive) financial analysis

By starting the design in consultation with the Executive Team and Chief Executive and then working in depth with the Chief Financial Officer constantly testing against the strategic goals and parameters of the organization all dimensions of the model (Locations, Functions and Accounts) are hierarchically described in a manner that places strategic information in the forefront of the default reporting sequence and therefore in the forefront of all query and reporting and even posting of information in the entire ERP environment.

This ensures that one consistent strategic view of the business is conveyed throughout the organization.

There is no "gee wiz" in this, it is simply the consequence of a senior and very experienced facilitator working with the executives of the client organization to design a high level structure that accurately reflects the strategic parameters of the organization – the essence of why it exists and how it thrives – the essential economic and other fundamentals of the business.

There is no short cut; the ONLY way to achieve a high value strategic focus is to start with the custodians of the strategic view of the business – the CEO, CFO and other members of the Executive team.

6. Structured financial taxonomy that covers the entire enterprise and ties it all together

The final result is a structured financial taxonomy that covers the entire enterprise and ties it all together.

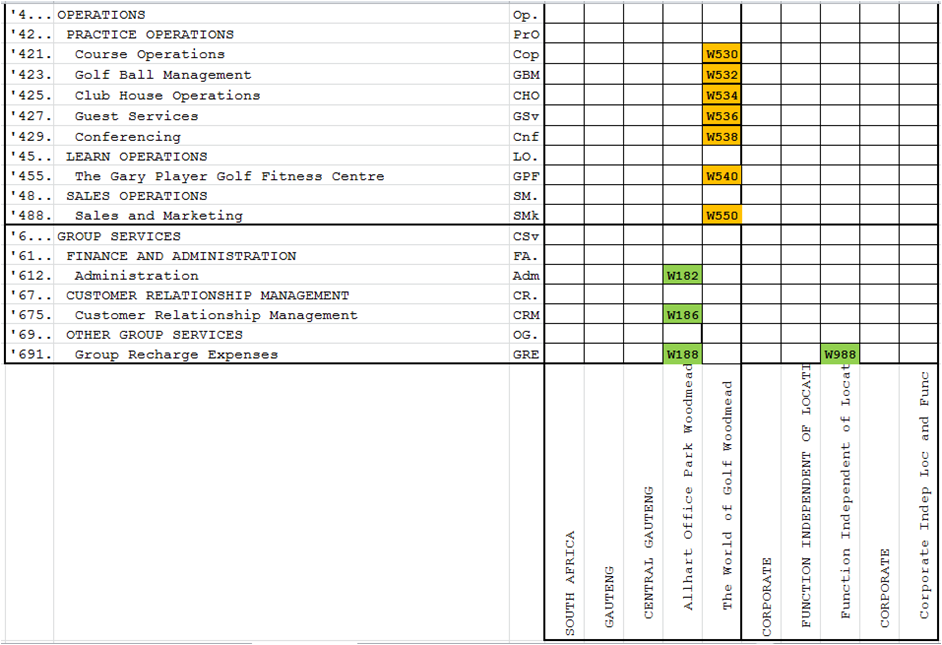

The cubic model – made up of individual businesses, locations, functions and accounts is all designed at the executive level to accurately reflect the real world in such a way that executives, managers and supervisors down to a fine level of detail are each presented with an accurate and entirely consistent income statement and balance sheet for the part of the business for which they are personally DIRECTLY ACCOUNTABLE.

Coupling this to accounting disciplines and policies ensures that journal entries are minimized and ownership of information is maximized. Other JAR&A principles in the design greatly reduce the need for overhead apportionment journals and the like. This approach is a radically better paradigm for most organizations.

Having said this it is important to recognize that the vast majority of business units in most organizations manage expenses and to a lesser extent assets so, in most cases, the sub-unit financial statement is purely a very detailed expenditure statement that can be readily measured against planned budgets and rolled up to achieve views for individual plants, functions, business units – any grouping that is relevant.

The Cubic Business model provides a robust model of the real physical world – locations are places you can walk to and kick, functions are tasks for which you will find personnel and sometimes machines doing things aligned with the fundamentals of the business.

The governance of this physical model sits in another layer, a reporting model that is implemented ABOVE the Chart of Accounts, NOT in the Chart of Accounts – the impacts of corporate restructuring and other reorganization are minimized and generally reduced to different groupings of the same building blocks in the reporting layer.

7. Radically improve accountability, governance, decision support, empowerment …

As indicated above the Cubic Business model is designed from a fundamental first principles strategic (essence of the business) approach that accurately reflects the physical (location) and functional dimensions of the business at a level of fine granularity that allows the business to present every executive, manager and supervisor with a precise financial statement that reflects ONLY those expenses and other components over which they have personal control and accountability.

Correctly implemented the Cubic Business Model can eliminate private calculations of performance and gets everybody managing off the financial system as they should.

With strong emphasis on holding all who control expenses and other financial components accountable for their exact numbers and through ensuring that those exact numbers come directly out of the General Ledger we find that the entire enterprise starts managing off the same source data.

The result is that the General Ledger becomes largely self-auditing – everybody is using it, everybody knows exactly where every transaction came from and everybody is held accountable. This is NOT a technology thing – the JAR&A SEPT Cubic Business Model and Group-Wide Chart of Accounts provides the logical content mechanism to make such rigorous use of systems possible BUT management focus and commitment to making the model work is VITAL to achieving a the benefits touched on above.

Once these mechanisms are in place the high levels of accountability immediately has a dramatic impact on governance AND leads to empowerment – as long as Joe is performing relative to budget and everybody trusts the numbers his superiors can leave him to run his business unit or sub-unit and concentrate on strategic issues and growing the business.

Because Joe has accurate, dependable, up-to-date numbers Joe can make better decisions and manage better and in his own right assist the organization to thrive.

The logical next step is that the audit bill goes DOWN!!!

The first time this happened I was caught completely by surprise – the audit was cut from 6 months to 6 weeks and the balance sheet was unqualified for the first time in 15 years!

8. Supported by sophisticated "GL Builder" software

As I mentioned in the history of the approach, I have always used computer software to help me assemble the model, it can be done manually in a spreadsheet but that is extremely tedious and error prone and maintenance becomes a MAJOR headache.

We have developed a suite of software which we call "GL Builder" which we use to assist us in building the Chart of Accounts and the Cubic Model.

This tool allows us to select the locations, functions and accounts that apply to a particular business unit, then select the functions and accounts that apply to a particular location and then the accounts that apply to a particular cell (location – function intersection) on the cubic model.

Thus we have an absolutely harmonized Chart of Accounts for each cell on the matrix – "Sales Personnel Commission" is ALWAYS the same account across the entire model, even if we have 500 branches in 50 countries we will always be able to compare like with like across the entire enterprise.

And the above matrix concept can be used as a presentation tool over the entire Chart of Accounts to display specific costs for example across the entire enterprise – your imagination is the limit in terms of what you can do in your Business Intelligence Tool and the data will now SUPPORT your imagination instead of getting in the way.

9. Can be implemented as a mapping layer in your Data Warehouse and used for acquisitions

Much of the above discussion has related to the use of the Cubic Model in an ERP, however, it can be used very effectively in the mapping layer (Transform element of the Extract, Transform, Load mechanism) of your Data Warehouse to unscramble the spaghetti on a 20:80 basis – 20% of the cost and effort to give you 80% of the strategic benefit.

Because of the highly structured nature of the Cubic Model and Chart of Accounts and the use of computer software to generate the model a model can easily be created for a potential acquisition at a summarized level and used in due diligence investigations in order to evaluate the viability of the proposed acquisition. The standard financial reports of your organization can be easily and quickly applied to the Trial Balance of the target organization so that you can evaluate their figures against your proven reports and analytical techniques.

For the same reason, once an acquisition goes through it is a relatively simple matter to map their existing Chart of Accounts onto your operational SEPT Chart of Accounts and start reporting to the same standards as the rest of your group.

As with all information technology the realization of the benefits outlined above requires effective implementation, proper training and rigorous discipline in the use of the computer based solution.

[MAKERATING]

The comment feature is locked by administrator.

Return